Introduction

The Permanent Account Number (PAN) is a crucial element of India’s financial landscape. This unique ten-character alphanumeric identifier assists in tracking financial transactions and ensuring compliance with tax regulations. While applying for a PAN card might seem straightforward, many individuals feel the need to engage an agent to navigate the process. However, understanding the application procedure and historical context can empower individuals to self-apply without the need for intermediaries.

This article delves not only into the systematic approach to applying for a PAN card but also explores lesser-known events, leaders, and cultural developments in Indian history related to taxation and identity that have contributed to the importance of financial documentation like the PAN card.

Historical Context of Financial Documentation in India

The Evolution of Taxation

Taxation has been a cornerstone of Indian civilization since ancient times. The history of taxation can be traced back to the Mauryan Empire (322–185 BCE), where Kautilya’s Arthashastra discussed various methods of taxation on agriculture, trade, and natural resources.

Colonial Era Tax Reforms

During British rule, tax policies underwent significant changes. The British introduced a centralized tax collection system that laid the groundwork for today’s taxation framework. One notable figure during this period was Lord Thomas Babington Macaulay, who’s educational and administrative reforms had a profound effect on how Indians perceived governance and financial responsibility.

Independence and Modern Taxation

Post-independence, India faced the challenge of building a nation with a coherent taxation system that ensured equitable economic growth. The introduction of different taxation forms and the necessity for a universal identity, like the PAN card, arose from the need to manage a vast and diverse economy effectively.

The Importance of the PAN Card

Tax Compliance

The PAN card plays a critical role in tax compliance. It ensures that individuals and entities are correctly identified in the tax system, enabling the government to efficiently track income and tax payments. This minimizes tax evasion and fosters a culture of transparency.

Financial Transactions

Beyond taxation, a PAN card is often required for various financial transactions, such as opening bank accounts, applying for credit cards, and purchasing high-value goods. It serves as proof of identity, significantly aiding in the verification process.

Historical Anecdote: The Role of RTT

In the late 20th century, during financial liberalization efforts, the introduction of data management systems, including the Revenue Tracking Tool (RTT), facilitated real-time tracking of taxpayer transactions. This shift heralded the need for a standardized identification mechanism, leading to the widespread adoption of PAN cards.

How to Apply for Your PAN Card Without an Agent

Step-by-Step Process

1. Eligibility Criteria

Before applying for a PAN card, ensure that you meet the eligibility criteria. Any Indian citizen, foreign citizen residing in India, or entities like companies and trusts can apply.

2. Gather Required Documents

You will need the following documents to apply for PAN:

- Proof of Identity: Voter ID, Passport, Aadhar Card, or any other government-issued ID.

- Proof of Address: Utility bills, bank statements, or any document that verifies your current address.

- Proof of Date of Birth: Birth certificate, school leaving certificate, or any official document stating your date of birth.

3. Choose the Application Method

You can apply for a PAN card online or offline:

-

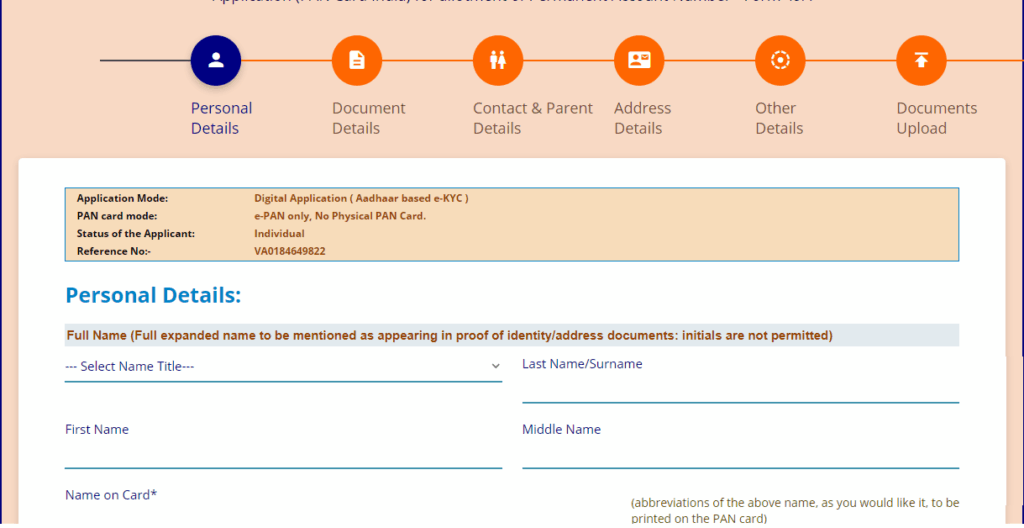

Online Application:

- Visit the official website of the Income Tax Department or the NSDL e-Governance website.

- Select the option for “New PAN” and fill in the requisite details.

- Upload the required documents and submit the form.

- Make the payment using appropriate payment options.

- Offline Application:

- Download the PAN application form or procure it from designated centers.

- Fill the form and attach the required documents.

- Submit the form at the nearest PAN application center or Income Tax Office.

4. Payment of Fees

The fee for applying for a PAN card varies depending on whether you are applying from within India or from abroad. Ensure you have the correct fee amount ready for online payment or attach a demand draft for offline applications.

5. Acknowledgment Receipt

Once your application is submitted, you will receive an acknowledgment receipt. This contains a unique acknowledgment number that you can use to track your application status.

6. Track Your Application

Visit the official website where you applied and enter your acknowledgment number. This will provide you with the status of your application and inform you when your PAN card has been dispatched.

Historical Anecdote: Impact of the E-Governance Movement

The rise of technology in the 21st century marked the beginning of a new era in governance. The Indian government initiated numerous e-governance projects aimed at enhancing transparency and minimizing corruption. The implementation of online PAN card applications was one such milestone, reflecting the broader e-governance movement and facilitating self-service for citizens.

Lesser-Known Events in Indian Taxation History

The Taxation Laws (Amendment) Act of 1975

In a significant but lesser-known event, the Taxation Laws (Amendment) Act of 1975 was introduced to enhance the effectiveness of tax laws in India. This act led to substantial modifications in tax regulations and laid the groundwork for better compliance and documentation requirements, fostering the importance of identification measures like the PAN card.

The Rise of Tax Reforms in 1991

Post-1991 Liberalization, India witnessed accelerated economic reforms, necessitating an overhaul of the taxation framework. This led to more rigorous compliance measures, reinforcing the significance of a universal identification number like the PAN, making it a critical component of India’s evolving economy.

The Role of Dr. Manmohan Singh

Dr. Manmohan Singh, as the then Finance Minister, played a pivotal role in crafting reforms that introduced the PAN card as a mandatory financial identifier. His visionary policies emphasized tax compliance and transparency, revolutionizing how Indians engaged with financial institutions.

The PAN Card’s Cultural Significance

Beyond its bureaucratic function, the PAN card symbolizes an individual’s identity within the Indian financial system. As financial literacy rises, the PAN card has become an emblem of empowerment, enabling individuals to participate actively in the economy.

Cultural Developments and Financial Literacy

The emphasis on financial literacy is crucial for understanding the socio-cultural dynamics surrounding the PAN card.

Initiatives for Financial Education

Numerous organizations, both governmental and non-governmental, have launched initiatives to educate the masses about financial literacy. Understanding the importance of a PAN card and how it integrates into the broader context of financial transactions reinforces civic responsibility and compliance.

Grassroots Movements

Various grassroots movements have emerged to educate rural populations about the significance of financial documentation, including PAN cards. Leaders in these movements often draw from historical examples of community organization dating back to the pre-independence era, focusing on equitable economic development and self-empowerment.

The Global Perspective on PAN Cards

While the PAN card is unique to India, many countries have similar identification systems to track financial activities and tax compliance. The evaluation of these systems provides insights into varied approaches and the cultural contexts that inform them.

The United States: Social Security Number (SSN)

In the United States, the Social Security Number (SSN) serves a similar purpose, acting as a unique identifier for tax payments and social services. The history of the SSN—introduced during the Great Depression—mirrors India’s journey towards creating a structured system for identity verification in financial matters.

The United Kingdom: National Insurance Number

The UK’s National Insurance Number, essential for tax and social security benefits, parallels the PAN card in function. Its implementation during the post-war period reflects a commitment to organized financial governance.

Conclusion

The PAN card is more than just a piece of plastic; it is a symbol of identity, responsibility, and engagement within the Indian financial system. By understanding the application process and historical context, individuals can overcome the barriers often associated with this essential financial document.

Empowering oneself to apply for a PAN card without the aid of an agent not only fosters independence but also contributes to a more transparent and accountable tax system. The stories and events that have shaped taxation in India enrich the narrative of the PAN card, serving as motivation for all citizens to actively participate in their governance and financial futures.

Throughout this exploration, from ancient taxation practices to contemporary financial reforms, it becomes evident that the act of applying for a PAN card encapsulates a larger journey of empowerment, identity, and civic engagement in the rich tapestry of Indian history.